The Only Guide for Hiring Accountants

The Only Guide for Hiring Accountants

Blog Article

Indicators on Hiring Accountants You Should Know

Table of ContentsA Biased View of Hiring AccountantsThe smart Trick of Hiring Accountants That Nobody is Talking AboutHiring Accountants - The FactsHiring Accountants - An OverviewFacts About Hiring Accountants Revealed

Hiring a pay-roll accountant includes a set of financial dedications. Contracting out generally includes a fixed fee or a cost based on the variety of workers and the complexity of your payroll requires. Relying on the size of your service and the services you need, the rate will differ. While this is an additional cost to include in your overhead, a pay-roll accounting professional can soon wind up spending for themselves.While you don't get a person working exclusively for your group, outsourcing additionally has great deals of its very own advantages. It is frequently an extra cost-effective service than hiring a person in-house, especially for small to medium-sized enterprises (SMEs) that may not call for a permanent pay-roll manager - Hiring Accountants. Prices here can range from a few hundred to numerous thousand extra pounds annually, depending upon the level of service called for

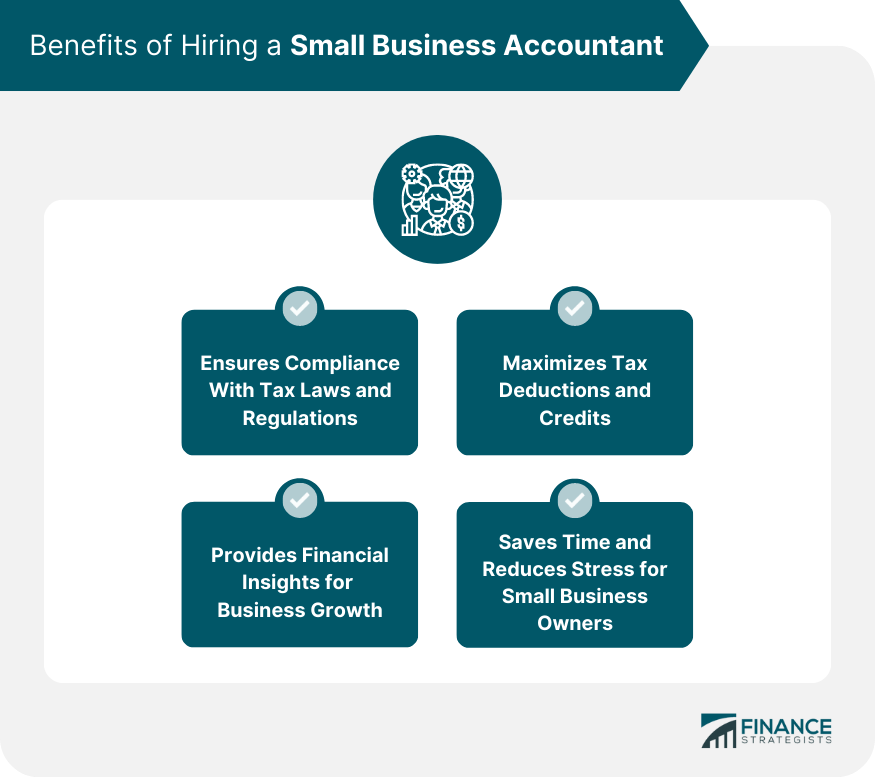

The UK's tax system, specifically pay-roll taxes, is complex and based on constant modifications. A pay-roll accounting professional makes certain that your company remains certified with HM Earnings and Customs (HMRC) laws, thereby avoiding potential penalties and legal problems. The peace of mind and security this gives can be vital. This can additionally aid to save you money over time.

Hiring Accountants Can Be Fun For Anyone

The moment spent by local business owner or various other employee on payroll can be considerable. If you function out the hourly pay for an elderly member of staff and accumulate the moment they are spending on payroll administration, it commonly can be a lot higher than the price of outsourcing.

This strategic input can lead to significant expense savings and effectiveness gains over time. This is where this specialist advice truly enters into its own and can give big benefits. Simply having a professional sight and someone to review your pay-roll with you can lead to far better decision-making and a a lot more enlightened process.

Investing in a payroll accountant or service can conserve companies money in the long run. By guaranteeing conformity, avoiding fines, conserving time, and offering tactical insights, the cost of working with a pay-roll accountant can be countered by the monetary and non-financial benefits they bring. While the initial time period may set you back even more than you get, you can be positive that what you are doing is benefitting your business, aiding it expand, and worth every dime.

An Unbiased View of Hiring Accountants

Scott Park, CERTIFIED PUBLIC ACCOUNTANT, CAFor most companies, there comes a point when it's time to employ a professional to handle the economic function of your business operations (Hiring Accountants). If you are at this factor in your business, then congratulations! You have expanded your service to the phase where you must be handing off a few of those hats you wear as an entrepreneur

Right here are the leading factors why you must consider outsourcing your accounting and tax needs to a specialist accountancy company. Do you have the time it requires to post the task, interview prospects and discover the best person? In addition, if you're not an accounting professional how her latest blog will you understand if you're asking the appropriate accountancy certain questions? For nearly every company around these days, it seems that a person of the most significant difficulties is discovering, hiring, and training new employees.

By outsourcing your accountancy, you're not simply obtaining one person's knowledge. This certainly comes in useful when you run right into a particularly challenging or extraordinary scenario with your business.

This will stay clear of unneeded interest and charge costs that might happen when points are missed out on or submitted late. Likewise, a certified public accountant accounting firm is needed to maintain a particular degree of expert advancement and they will certainly depend on day on one of the most current tax obligation changes that occur yearly.

Hiring Accountants Things To Know Before You Get This

internet site give information of a general nature. These blog messages need to not be considered particular recommendations considering that each person's personal monetary circumstance is distinct and fact particular. Please contact us before implementing or acting on any of the info consisted of in among our blog sites. Scott Park & Co Inc.

Several organizations reach an area in their development where they require somebody to handle the company finances. The inquiry after that becomes not, "Do we require an accounting professional?" however instead, "Ought to we contract out or bring a person navigate here onto the team to supply audit services for our business?" There can be advantages and imperfections to every and what you decide will ultimately depend upon your details company needs and goals.

Getting The Hiring Accountants To Work

When tax obligation season is over, the accounting department slows down substantially. Throughout these sluggish times, an in-house accounting professional will certainly still be on salary and coming into the office each day.

You'll need to spend for the software needed for an internal accounting professional to finish their task and also the furnishings and supplies for their workspace. An audit company will certainly currently have all these programs, and they'll always have the that site most recent subscriptions of the most desired software. Their team will be appropriately educated and will get any type of essential training on all updated software application.

Report this page